Watch October’s Cup of Joe

Get the full breakdown in this month’s video.

How is the shutdown going to affect my investments?

- Initially, there should not be a substantial economic impact.

- Historically, government shutdowns don’t last that long. 8.5 days on average.

- The size of the US economy is over $30T annually. It would take a significant amount of time for shutdown-related hindrance to really add up to a meaningful amount.

Ripple effects

- US stock valuations are expensive. The shutdown may spark profit-taking as investors wait for clarity.

- The Fed may err on the side of easing, regarding interest rate policy, which is usually good for stocks.

Guarding with good habits

- The Argent Bridge Investment Committee recently decided to rebalance our investment models. Trimmed US equities, brought bonds back to full target weight, and slightly increased allocation to international stocks.

Recent 60 Minutes interview with Andy Sorkin appeared to prognosticate a market crash

- The overly-simple question “Is the market going to crash?” was answered by “Yes, but…”

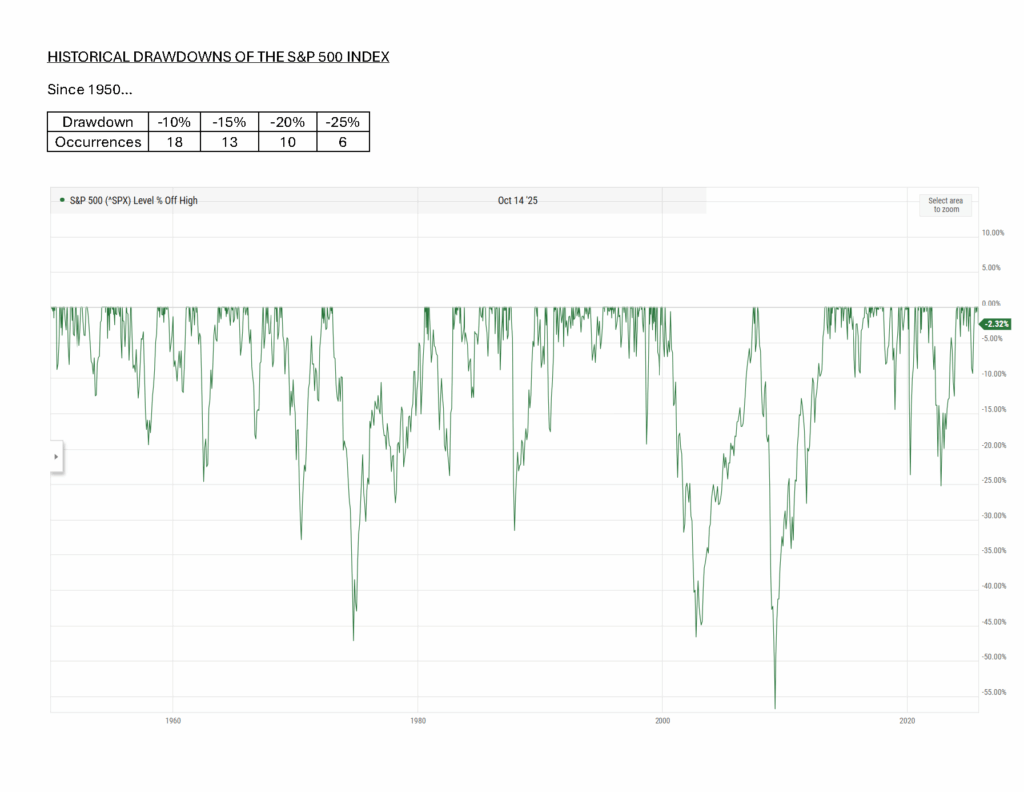

- Historically, market declines are frequent. The answer could always be “Yes, but…”.

- Today’s market seems to be different from past bubbles because companies’ cash flows and fundamentals are materially different.

- This is not the speculation of unprofitable internet companies like the late 90s.

- Nor is it housing exuberance fueled by subprime lending of the 2000s.

- The rebalance of our investment models trims exposure to expensive US equities, bolsters weight in bonds, and increases allocation to international markets that aren’t’ exhibiting bubble characteristics.

Joe Gallemore CIMA®, CExPTM

Partner & Director of Investment Management