Retirement Planning

Clarity, Strategy, and Confidence Through Every Stage of Retirement

Guidance that Evolves with You

Looking Ahead with Clarity and Confidence

A well-designed retirement plan brings clarity and peace of mind. We help individuals and families navigate the complexities of retirement with personalized guidance and clear strategies. Our experienced team works closely with you to develop a tailored retirement plan that supports your goals, lifestyle, values, and legacy. From income planning and tax-smart withdrawals to Social Security optimization and healthcare decisions, we build a framework that adapts as life changes.

Whether you’re focused on protecting your own future or setting your children up for success, we’ll help you build a plan that supports both.

Let us bring clarity to your retirement journey and help you move forward with confidence.

Where are you Today?

Every Phase Brings Opportunity. Let's Make the Most of It.

Pre-Retiree

The foundation for financial freedom starts here.

This stage is about optimization. We align your portfolio, reduce tax friction, and prepare you for a flexible and confident retirement.

Retirement

Activate your plan with purpose.

This stage is about optimization. We align your portfolio, reduce tax friction, and prepare you for a flexible and confident retirement.

Retirement Funding

Keep your finances working for the life you want.

As your routines evolve, we focus on sustaining income, simplifying your financial life, and managing healthcare costs without compromising how you live.

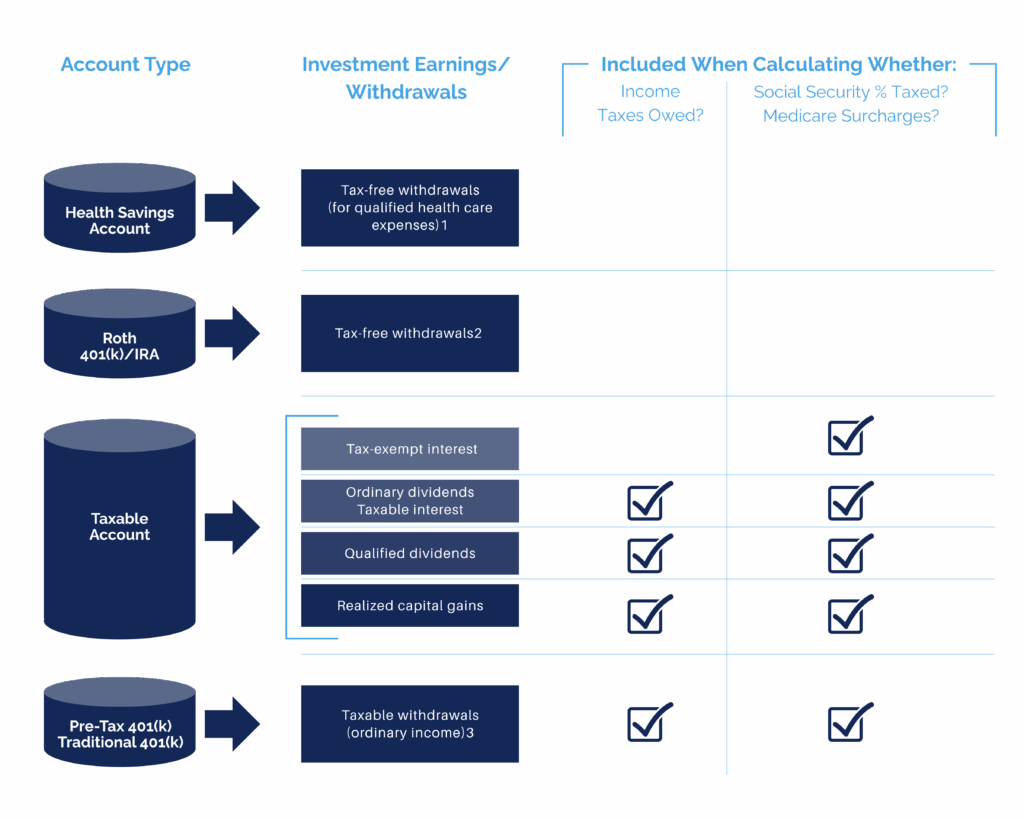

Diversified Sources of Retirement Funding

Retirement Funding Sources are not Created Equal

Be aware of:

- Income taxes

- How much Social Security benefit is subject to tax

- Additional required Medicare premiums

Qualified withdrawals from Roth or Health Savings Accounts can provide tax-free funding that will not result in reduction of government benefits.

This is not intended to be individual tax advice; consult your tax professional.

1Must have a qualifying high-deductible health plan to make contributions. Funds in the HSA may be withdrawn tax free for qualified medical expenses unless a credit or deduction for medical expenses is claimed. After age 65 funds also may be withdrawn at ordinary income tax rates without penalty for any reason.

2Subject to 5-year Roth account holding period and age requirements.

3Withdrawal of non-deductible contributions from a traditional IRA are not taxable.

Source: J.P. Morgan Asset Management.

Stay

Connected

Sign Up for Insights that Matter Inspire Empower sent right to your inbox

Our Capabilities

Planning Beyond Today

Personal By Design

Collaborative Planning

Forward Focused

Planning With a Purpose

Simplified Decision-Making

Built to Adapt

Why Choose Us

Confident Retirement Starts Here

We help you prepare for every phase of retirement: building your financial foundation, navigating your transition, and sustaining your lifestyle. It’s not just about having enough. It’s about putting your savings to work with clarity and purpose.

Your retirement plan reflects the life you want to live, not just your account balances.

Your plan is built for today and designed to adjust as life changes.

You'll always understand the reasoning behind our recommendations and how they support your goals.

We keep your broader advisory team informed and aligned.

Whether you're approaching retirement or already living it, we help position your assets wisely.

We stay connected through every chapter, not just the big moments.

Retirement Readiness Check

Clarity Starts with Context

Are You On Track?

Shift from Scarcity Thinking

to a Mindset of Strategic Abundance.

Ready to start the conversation? Send our team a message to explore how we can support your retirement goals.